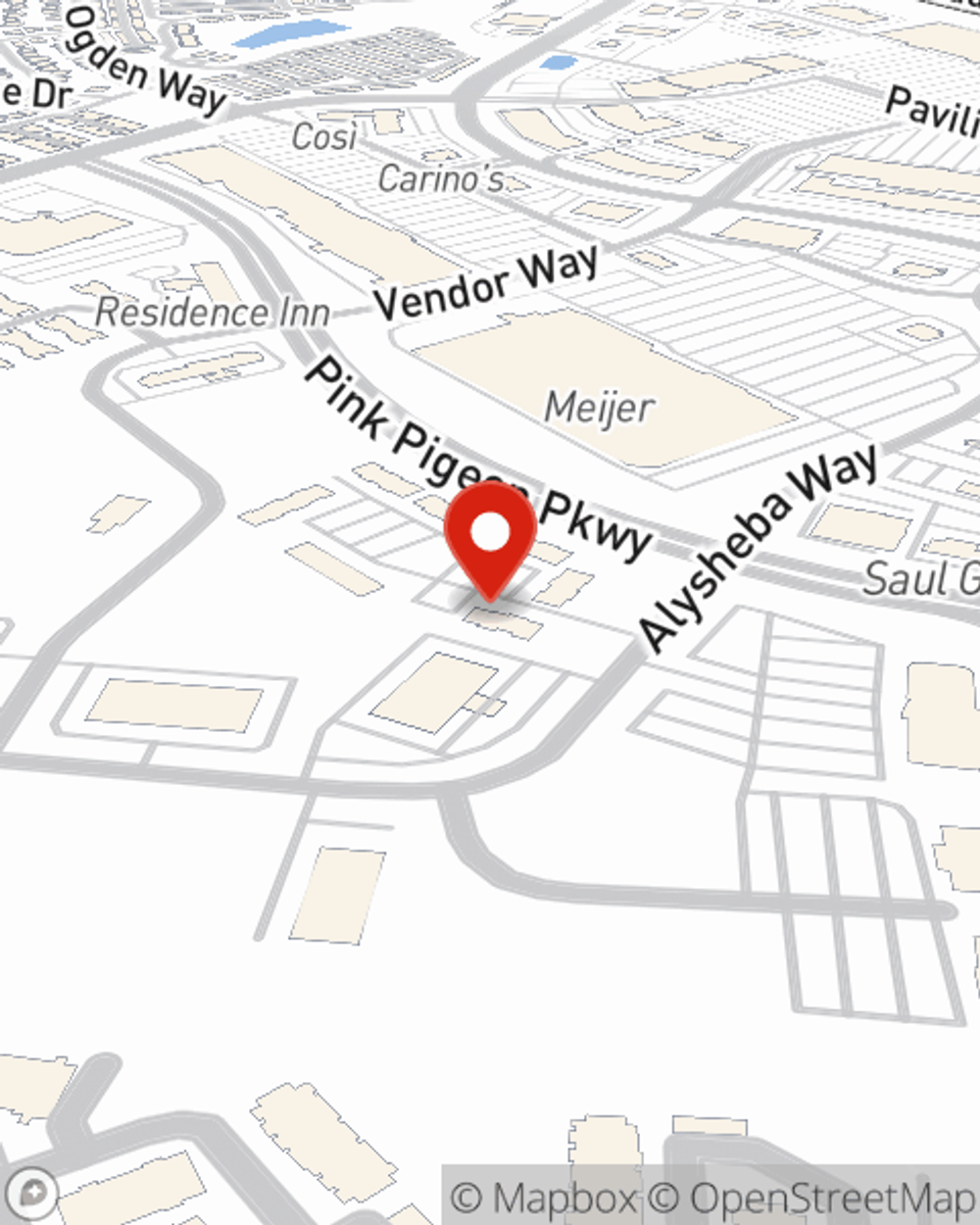

Business Insurance in and around Lexington

One of Lexington’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

- Lexington

- Versailles

- Lexington-Fayette

- Nicholasville

- Paris

- Georgetown

- Winchester

- Lawrenceburg

- Frankfort

- Richmond

- Danville

- Berea

- Jessamine County

- Mount Washington

- Stamping Ground

- Lancaster

- Brannon Woods

- Centerville

- Midway

- Keene

- Vineyard

- Wilmore

- Pinckard

This Coverage Is Worth It.

Running a small business requires much from you. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, contractors, retailers and more!

One of Lexington’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Surprisingly Great Insurance

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for commercial auto, artisan and service contractors or business owners policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent John Parkhurst is here to help you discover your options. Get in touch today!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

John Parkhurst

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.