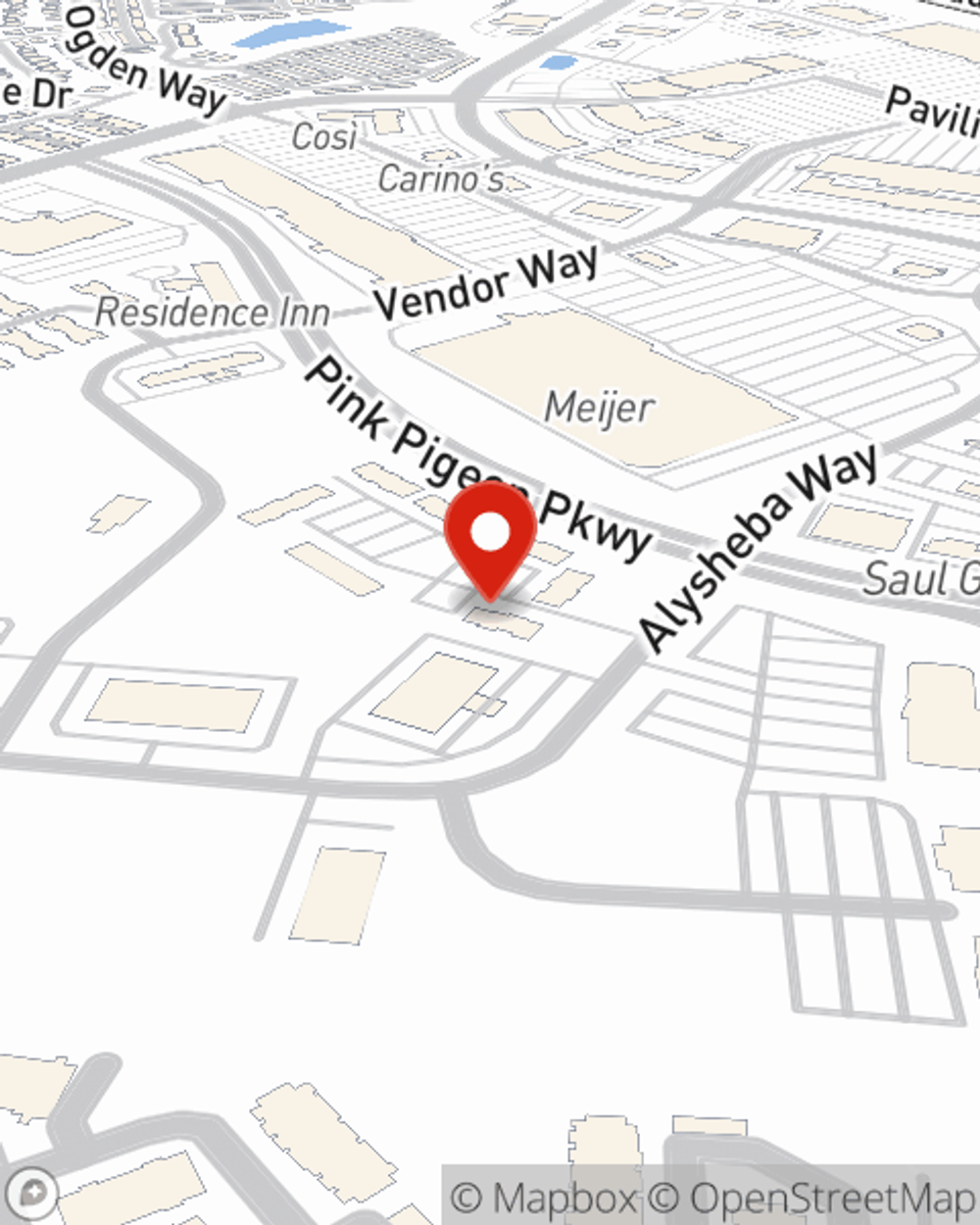

Insurance in and around Lexington

Need insurance? We got you.

Insurance that works for you

Would you like to create a personalized quote?

- Lexington

- Versailles

- Lexington-Fayette

- Nicholasville

- Paris

- Georgetown

- Winchester

- Lawrenceburg

- Frankfort

- Richmond

- Danville

- Berea

- Jessamine County

- Mount Washington

- Stamping Ground

- Lancaster

- Brannon Woods

- Centerville

- Midway

- Keene

- Vineyard

- Wilmore

- Pinckard

A Personal Price Plan® That’s Uniquely You

Your loved ones and your home are some of what's most important to you. It's understandable to want to protect them. That's why State Farm offers fantastic insurance where you can build a Personalized Price Plan to help fit your needs.

Need insurance? We got you.

Insurance that works for you

We’re There When You Need Us Most

Some of these wonderful options include Motorcycle, Pet, Health and Boat insurance. Not only is State Farm insurance a great value, but it's a smart choice.

Simple Insights®

Getting off to the right start: Auto insurance for foreign drivers

Getting off to the right start: Auto insurance for foreign drivers

If you are visiting the U.S. or are an immigrant that recently arrived in the country, car insurance is essential if you plan to drive.

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.

John Parkhurst

State Farm® Insurance AgentSimple Insights®

Getting off to the right start: Auto insurance for foreign drivers

Getting off to the right start: Auto insurance for foreign drivers

If you are visiting the U.S. or are an immigrant that recently arrived in the country, car insurance is essential if you plan to drive.

Clothes dryer maintenance tips

Clothes dryer maintenance tips

These simple tasks can help extend the life of your dryer. Find out how to clean the inside of a dryer, how to clean your dryer vent and more.